My 14-year Investing Journey

A brief look at my investing journey and portfolio performance so far.

The Beginning

Back in 2008-09, when the markets came tumbling down due to the Great Financial Crisis, I was just starting my professional career.

With a low starting salary and an even lower amount of money to save and invest in that difficult market, my tryst with personal finance had been baptized with fire. However, serendipity and providence were going to guide me and lead my hand in this endeavor; which I had no idea of back at that time.

My first salary account was with a lesser-known bank called Centurion Bank (does anyone remember?) that got acquired by HDFC Bank shortly after my first few months of salaries were credited. And with a big, private bank came its own “benefits and privileges” – or more clearly – salesmen called Relationship Managers.

A banker is a fellow who lend his umbrella when the sun is shining and wants it back the minute it begins to rain

– Mark Twain

My RM was quite smart, but clever at the same time. He advised me against credit cards (good) but got me to open a Demat account (not so good for a 21-year old). I am sure he had his own targets to achieve in a difficult equity market where everyone was fearful. But as luck would have it, this gentleman made me buy two good stocks along with a couple of substandard ones.

These two stocks were : Infosys and HDFC Bank (maybe he got extra commissions for making me buy their own stock? I’m not sure).

One has to keep in mind that both these scrips were trading at extremely good valuations during that time. I had around 50k with me to deploy into the market then, and he helped me buy a few shares of these two companies. I ended up buying a few more shares of them in the subsequent months, but only at this RM’s behest.

As luck would have it, I relocated to the United States for about three years at this point for work and my Indian bank account remained dormant between 2010-2012. Since there was no Netbanking facility activated for my account at the time, there was no way I could access my investments or money the way I could otherwise.

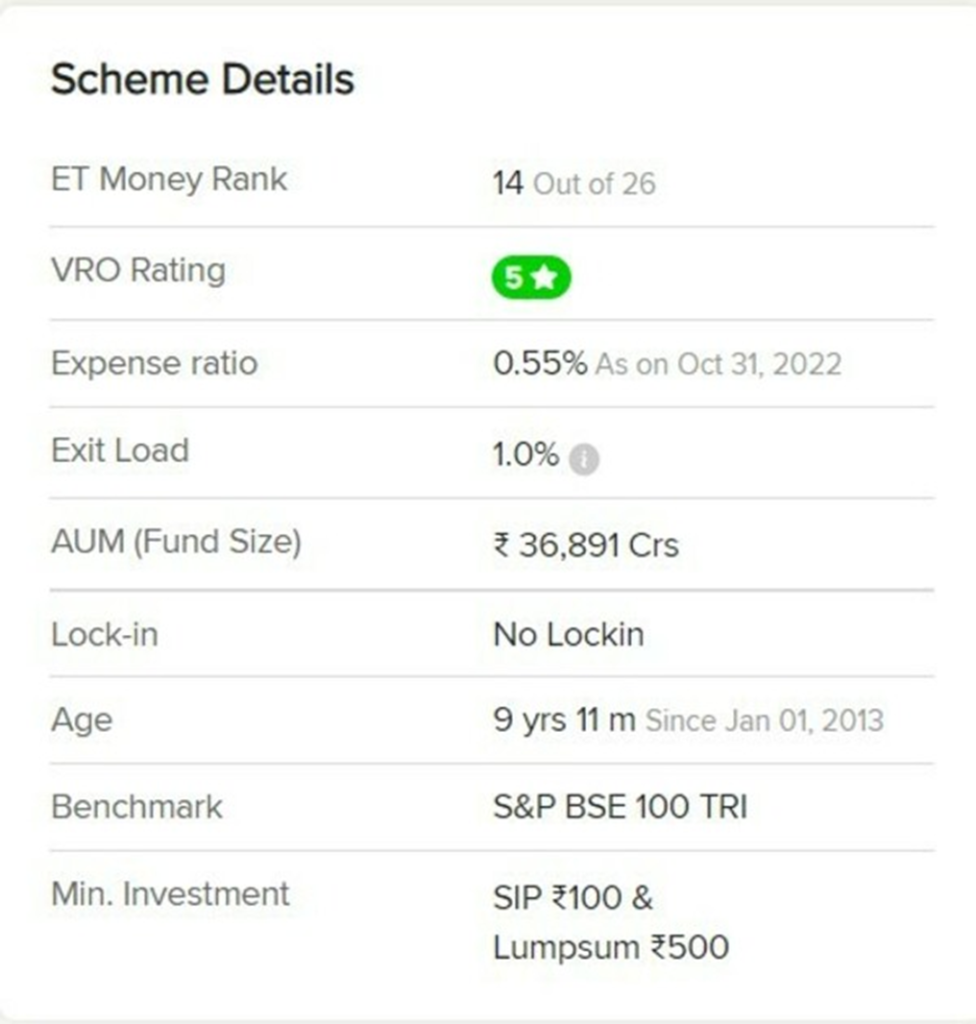

The only investment I did during this period was to initiate a mutual fund SIP at the behest of a friend of my mother’s – who was also an LIC agent in addition to a mutual fund distributor. The SIP amount would get debited from the money I sent to my parents every month from the US. More on this later.

I returned to India in late 2012 – by which time the markets had recovered and was clearly on a path to a bull run – and was called into the bank branch by a different RM (I learned that my previous RM had left for another bank later) who told me that I need to register something called “KYC” and activate my “Netbanking”.

This particular visit would leave me spellbound and help me learn a very important lesson.

The Light Bulb

In early 2013, I walked into my HDFC Bank branch and sat across my new Relationship Manager.

He was helping me verify my KYC and activate Netbanking on my account. While it was going on, I noticed a pretty big chunk of money that was showing up under “Demat” – you could not miss it, because it was almost worth multiple months of my salary.

I asked him where did that money suddenly come from, and got an astounding answer – “Sir, these are your stock holdings. Looks like you bought them three years ago and forgot about it.”

Forgot about it.

He was absolutely right. I had entirely forgot about my equity investments that I made in 2009-10 before I left for the US. And meanwhile, India was in a roaring bull market that had multiplied by investments by a great margin. It was a pleasant surprise, but also a valuable lesson hiding in plain sight.

Equity investments make money in the long term as long as you do not disturb the compounding process.

This was the proverbial light bulb. Though it was made possible by sheer luck and providence, I had learned the first lesson in personal finance and investing. A lesson that I have kept dear to my heart over the past14 years.

Our favorite holding period is forever.

– Warren Buffett

The Journey

From 2013 – my light bulb moment – onwards, I made a promise to myself to learn more about how equity works. I wanted to know what a shareholder gets when he invests, the true meaning of equity, how mutual funds work and how companies grow and create wealth in the long term.

Back then, financial education was not easy. There were few influencers on social media – Instagram was brand new and Twitter still did not have the reach it has today – and good beginners’ books were far and few in between. Luckily, my Google searches guided me to the legendary Benjamin Graham and also Adam Smith – the father of capitalism – through their books The Intelligent Investor and The Wealth of Nations.

The intelligent investor is a realist who sells to optimists and buys from pessimists.

– Benjamin Graham

I have to say these are two books that every investor must read – these are the originals from which thousands of investing books have been inspired, and while others may give useful points of view, nothing can beat the original. They changed how I look at life, let along my investments.

If you would like to learn more about the basics of asset classes, personal finance and long-term investing, do check out my top-rated course on Udemy here: The Ultimate Guide to Personal Finance & Investing

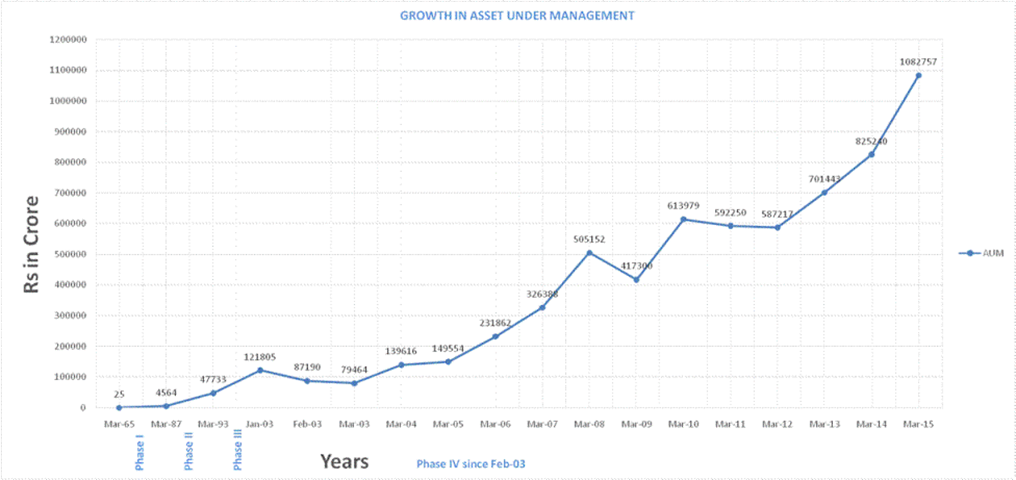

From 2013 onwards, I started investing with intent. I did tremendous studies on various companies in India with a 7-10 year investment horizon, and added two more mutual funds into my portfolio. My initial analyses mainly focused on PE/PB ratios and profitability of a company, but later on I developed my own strategy to pick my stocks that looked at other variables and the market as a whole (I share this strategy on my advanced fundamental analysis course, more on this later).

Some of the companies that I picked up during that time were:

- Bajaj Finance

- Deepak Nitrite

- Sonata Software

- HDFC Ltd

I still hold these stocks in my personal portfolio.

Over the past nine years, my portfolio has given me a return at CAGR of 21.3% and my mutual fund portfolio has given me an XIRR of 17.7%

And the funny thing is, my portfolio – which currently has 17 stocks – consists of mainly profitable, low-debt companies that everyone knows! I did have three small cap multibaggers over the past years, but the majority of my portfolio are well-known businesses that have great management, low debt-to-equity ratio (70% debt-free stocks), consistent ROE and Revenue to Sales growth.

I have always focused on four things while selecting my stocks:

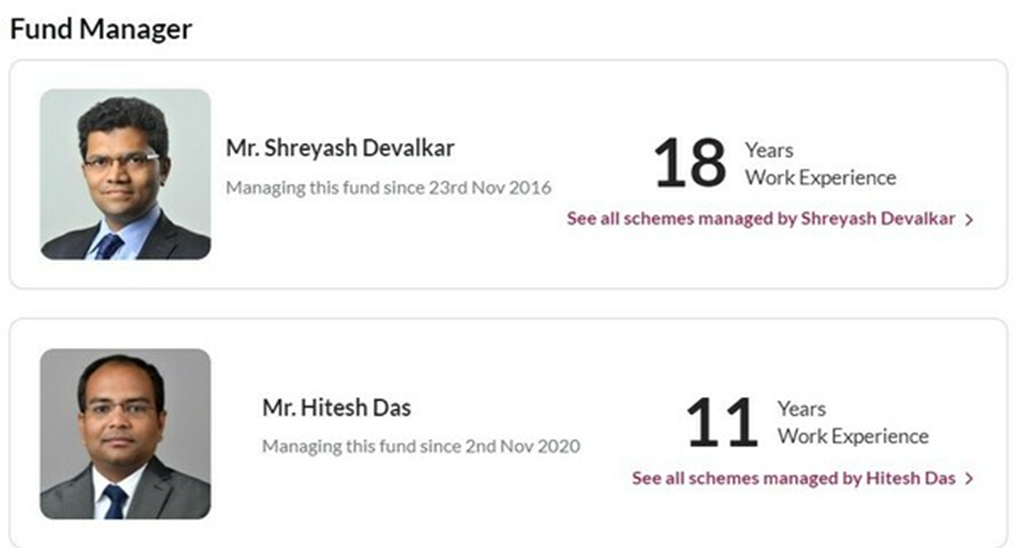

- Good Management

- Consistent (and not high) returns

- Reasonable valuation

- Clever management of debt and cash

What I want the reader to take away from my journey is that, you do not need to spend countless hours of your valuable time poring over the financials of lesser-known companies or doing scuttlebutt on businesses that you feel are undiscovered to create wealth in the stock market.

You need to invest in quality, profitable companies that you know well and believe in, while holding on to those investments for the long term.

What does long term mean? It means different things to different people – for a 21-year old, it can be 20 years and for a 50-year old it can be less than 10 years. It is personal, and that is exactly why it is called Personal Finance.

The Takeaway

As a 21-year old, luck and providence did play a big part at the start of my investing journey. There is no doubt about it, and if someone underplays the role of these two to you, disregard that person’s point of view. Whether you call it serendipity, luck or God’s grace, there is an element which we, as humans, cannot fathom in finance and investing.

The first thing any new investor needs to do is to learn. Without learning how the economy works you wouldn’t understand how the market works. Without learning how equity works you wouldn’t understand the need to invest for the long term. Without learning how compound interest works you wouldn’t understand why you should never disturb the compounding process.

So learn.

Compound interest is the eighth wonder of the world. – Albert Einstein

Once you clearly understand how asset classes, markets and the economy work you can start your own investing journey. I cannot guarantee that your portfolio will perform at a certain level, but what I can say for sure is that the stock market has always gone up and to the right always in the long term. So if you can be patient, and have a long-term mentality, compounding interest will make you wealthy – whether you like it or not.

And remember – time is the only resource that is truly finite in our lives, your portfolio has infinite potential to grow, just like India’s economy.

Happy investing!

Ajay

Leverage

Leverage

Fig 1. USDINR rates since Independence. Until 1991, Indian FX market was highly regulated.

Fig 1. USDINR rates since Independence. Until 1991, Indian FX market was highly regulated.