Redington Ltd – Big Leap Coming for the Future?

One of the biggest IT distributors in India with access to major global markets, maybe poised for its next phase of growth.

Introduction

Founded in 1993, Redington India Ltd has emerged as a leading supply chain solutions provider in the technology and telecom sectors. With its headquarters in Chennai, India, the company has established itself as a prominent player in the distribution and services space. Redington’s core focus lies in distributing an extensive range of IT products, mobile devices, and consumer electronics to a diverse network of resellers, retailers, and corporate clients across India and other countries.

It is currently an $8.4 billion technology solutions provider with more than 290 international brands in its distribution network in more than 38 markets.

In this brief research report, we will focus on Redington’s fundamentals, SWOT analysis, recent performance and the possible reason for a fall in stock price (which gives us a great buying opportunity).

Fundamentals

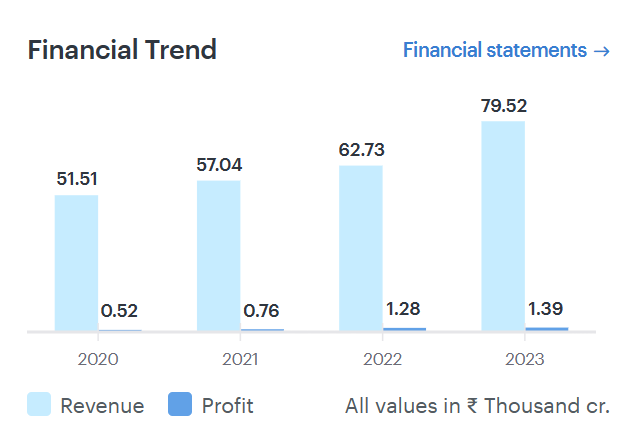

The company has impressive financials, with a very attractive PE ratio of 8.65 and a PB ratio of 1.61. This means that the company is valued very close to its actual book value and the earnings are very much in line with its stock price. In addition, Redington has been a consistently dividend-paying company throughout its history, with a latest yield of 4.8%. The latest dividend payment was on 7 Jul 2023 with INR 7.2/- paid for every share. Redington also has a very attractive debt profile with net debt to equity at a heathy ratio of 0.6.

Financial Trend of Redington (courtesy Zerodha/Ticker Tape)

If you have listened to my podcasts, and my Udemy course then you will know that I really love companies with low debt, and in fact most of the companies in my Indian portfolio are either zero-debt or low debt companies.

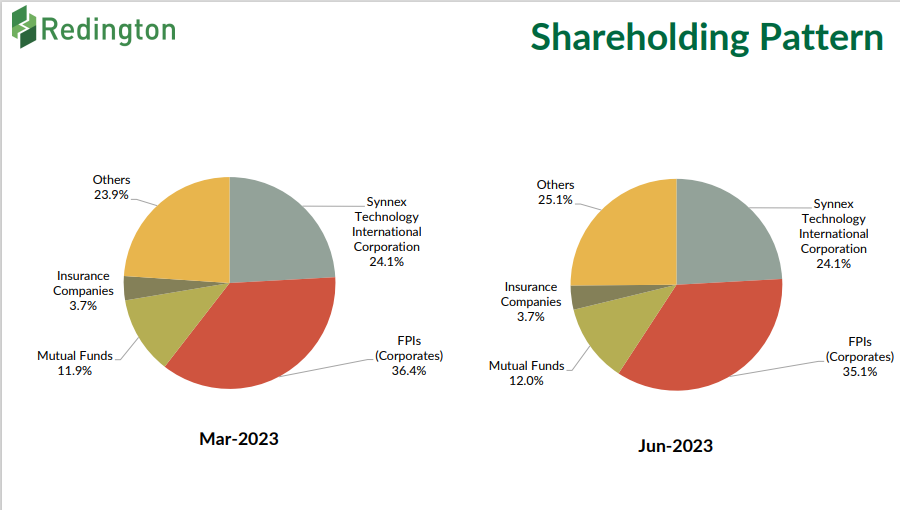

Let us look at the shareholding pattern of Redington now. There is some very interesting data there:

Redington Shareholding Pattern

The company has no promoters. That’s right, it is owned by various shareholders with foreign ownership at a whopping 59%! The Synnex Technology Corporation (NYSE: SNX) is an American company that is also an IT distributor in the US and the rest of the world. I have observed that any company having a significant ownership from FIIs and FPIs are always much better in quality. Another such a stock is SHRIRAM FINANCE (which we will talk about in detail, stay tuned). So, this also reinforces the excellent fundamentals that Redington has and makes it a good stock to invest in.

Since listing the company has created enormous wealth for its shareholders with almost 800% growth in stock price. The company has also maintained a high rate of profitability which has started accelerating in the past 5 years. The ROE of the stock over the past 10 years has been an impressive 18% and ROCE at 26%. These are great fundamental returns for a stock with the market cap of Redington and this means that the growth and expansion stage has just started.

Strengths

Current Market Position

Redington has a strong market position in the IT products distribution within India along with Ingram Micro Pvt Ltd (another major player in this industry) garnering the major share of the market in domestic IT distribution. The company is also the market leader in the Middle East and Africa (MEA) markets through its step-down subsidiary, Redington Gulf FZE, while its step-down subsidiary, Arena Bilgisayar Sanayi ve Ticaret A.S. (Arena), is one of the largest players in Turkey. It has strong relationships with leading vendors such as HP, Dell, Samsung, Lenovo, Cisco, and Microsoft in the IT products business, and has over time consolidated its position as a leading distributor for these vendors.

Revenue Streams and Diversification

REDIL’s revenue stream is highly diversified in terms of the IT, mobility, and service business verticals, as well as geographically with REDIL present in 38 markets. The IT consumer segment handles the distribution of personal computers (PCs), laptops and other consumer lifestyle products, while the IT enterprise segment caters to networking, software, server storage, cloud services. In the mobility vertical, REDIL primarily focuses on smartphones. The company has gradually enhanced the proportion of mobility revenue in its overall revenue supported by the rapid penetration of smartphones in the domestic market as well as overseas market leading to share of mobility revenue increasing to 32% in fiscal 2023 compared to 27% in fiscal 2018.

Liquidity Position and Risk Management

Redington has been doing a great job at generating cash (which is one of the most attractive things about a company to invest in) and also maintaining a good risk management profile in its business. These two are very important in my opinion, because even the great Warren Buffett has said that some of the best companies he has invested in, have been amazing cash-generating businesses.

The company enjoys strong liquidity, with cash surpluses of about Rs. 1951 crore as on March 31, 2023, and bank lines of Rs.2800 crores which has been utilized on an average at 12% over the past 12 months ended April 2022. Now this means that, even though Redington had a credit line to the tune of Rs. 2800 crores, only 12% or Rs. 336 crores have been utilized by them. Imagine having a credit card with a limit of Rs. 2800 but using only Rs. 336 because you that’s all you need! This means they are using their credit lines very judiciously. Another green flag.

During fiscal 2023, Redington generated net cash accruals of over Rs.1000 crore (post adjustments for dividend outflow of Rs 515 crore). The company’s cash accruals are expected to remain healthy and is expected to be sufficient to meet capex and working capital requirements.

Most Recent Performance – Q1 2024

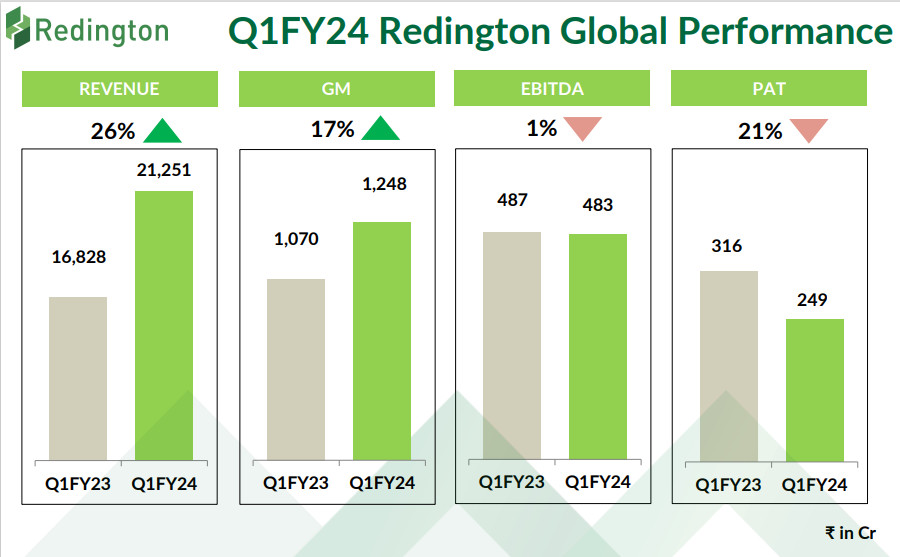

Redington has had a really good Q1 2024 performance, that is evident from their earnings results where the company reported a 26% higher revenue than the corresponding quarter in FY23. Also, this is the highest ever quarterly revenue in the history of the company at 21,250 crores. Let’s take a look at the numbers:

Redington Q1FY24 performance – Highest Quarterly Revenue Ever

So, what is the reason behind its fall in stock price recently?

In addition to the existing market downturn that has been triggered due to the US interest rate scenarios, one of the major reasons has been the stepping down of its Managing Director Mr. Rajiv Srivastava for personal reasons. You see, the markets do not like it when stable companies’ top management resigns for unclear reasons. This is one of the triggers for a sell for most investors as there could be impending issues that are flagged by such a resignation.

Most top management officials either “retire” or move on to better opportunities and announce the same publicly, so as to not create panic in the markets or minds of investors. Mr. Srivastava has been with Redington since April 2021 in the capacity of Joint Managing Director and then was elevated to Managing Director in April 2022. Now, Mr. Srivastava has had a stellar career – he was formerly the MD and CEO of Indian Energy Exchange, and during his stint at IEX, he transformed the publicly listed company into a diversified business enterprise that significantly improved shareholder value. If you have been following us on Twitter or Instagram, then you would know that IEX is part of my Indian portfolio.

So, the departure of such an eminent professional at such short notice has definitely dented the confidence of the investors. From my point of view, this could be because of a genuine personal reason and does not pose any serious challenge to the performance of the company. Instead, this depression in stock price can be a valuable opportunity to buy.

So, there you have it – a quick brief on this amazing company and why I’m invested in it for the long term. With its strong fundamentals, this one is a pick for the future.

Disclaimer: The above article is for informational purposes only. The author has long positions in the stock mentioned above. Please consult your certified financial advisor before investing.