A Zero-debt, Diversified Small Cap that Owns 70 acres of Prime Land in Mumbai!

What if I told you one of the best real estate small cap companies in India was debt-free and also holds 1600 crores in cash reserves?

Introduction

If you have been to Mumbai, then you would know that the two affluent suburbs of the city are Goregaon and Malad. And the latter is landmarked by Mindspace, that huge IT complex which makes everything look smaller in the vicinity. Similarly, there is another IT Park that stands tall in Goregaon. If you have ever driven on the Western Expressway, you cannot miss this one – the NESCO IT Park.

And today we will take a look into the company behind it.

NESCO Limited, also known as the New Standard Engineering Company Limited, is an Indian company with a rich history and a diverse range of business interests. Founded in 1939, NESCO has evolved over the decades and established itself as a prominent player in various sectors of the Indian economy.

Let us first look at a brief overview of NESCO Limited:

NESCO Limited was originally established as the New Standard Engineering Company in Mumbai, India, in 1939. The company started as an engineering and construction firm, primarily focused on industrial projects. Over the years, NESCO has diversified its business interests. Today, it operates in multiple sectors, including:

Real Estate: NESCO is well-known for its extensive real estate holdings, particularly in Mumbai. The company owns and manages commercial and industrial properties, including the iconic Bombay Exhibition Centre (BEC), one of India’s largest exhibition and convention centres. Also, if you have ever been to Goregaon, you cannot miss the NESCO IT Park, one of the largest in the city. NESCO has a land bank of 70 acres in Goregaon (I know right!) of which almost 80% has been utilised for the IT Park and the rest used for green spaces.

The NESCO IT Park in Goregaon, Mumbai.

Infrastructure: NESCO is actively involved in infrastructure development, through its wholly owned subsidiary Indabrator, the construction of roads, bridges, and other civil engineering projects. They are a significant player in Maharashtra and Gujarat and has a good hold in Mumbai for EPC projects.

Information Technology: NESCO has a presence in the IT sector through its subsidiary, NESCO Tech Limited, which provides a range of IT solutions and services. This is in addition to their IT Parks.

Bombay Exhibition Centre (BEC): One of NESCO’s most significant assets is the Bombay Exhibition Centre, India’s largest exhibition centre, which has become a hub for trade shows, exhibitions, and conferences in India. It hosts a wide variety of national and international events, contributing to India’s economic and business growth. The charges to showcase at BEC are one of the highest in the country, and with the elevation of Mumbai to newer heights with economic expansion in this decade, these charges are slated to go higher.

The Bombay Exhibition Centre (BEC) is the largest in India.

Food: Now this is something I am particularly interested in. Everyone knows that, with the huge population in our country and especially the cities, the food segment is a goldmine. NESCO has its own food brands that they promote through their cafeterias and canteens in the IT Park and elsewhere that spans from snacks to fine dining. I personally think there is a whole lot of scope of expansion in this particular segment. Currently the revenues from this segment are 11.65 crores and has the potential to go north of 50 crores in the next two years.

Zero debt, Large Cash Reserves and Latest Performance

I love companies with low debt. But having zero debt and managing almost 1600 crores in cash reserves? Now that is something made of dreams! NESCO has been a very financially responsible company from its inception and the company has been without any debt for years. In addition, they transfer a good portion of their net profits to their cash reserves (after paying the dividends, which has been very consistent) so that any business expansion can be financed internally and not with external borrowings.

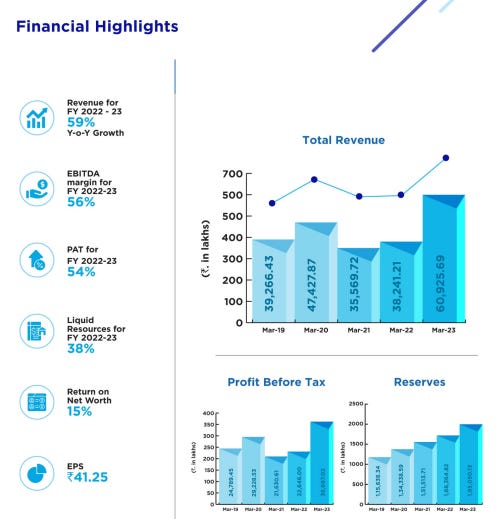

Let us take a look at the performance of the company for FY2023:

(Source: NESCO Annual Report FY2023)

As you can see from the above, there is a clear drop in revenues and profits during the COVID-hit FY2021. But the numbers have been solid since then on a nice, gradual upward trajectory. I like to see a slow but consistent growth in numbers instead of haphazard volatility, and these graphs above are almost cathartic for me to see.

Being a real estate company primarily, being debt-free takes on an even better form because we know that even during a slowdown (which affects real estate the most), the company will thrive without having to resort to loans or worse go bankrupt. So, this also makes NESCO a great business in my opinion.

Future Outlook

The NESCO IT Park has a 90% occupancy rate with marquee clients such as BlackRock (world’s largest investment fund with AUM of $8.5trillion), HSBC, pWC, KPMG, WeWork and MSCI (Morgan Stanley Capital Index – a company that provides indexing services to financial markets worldwide) with two major towers. This occupancy rate is set to continue and the rental income from the same is set to increase in the future – especially with BlackRock forming a JV with Jio Financial Services and expanding further in India. The revenue from real estate has been increasing at a CAGR of 11%.

But the outliers in the business were NESCO Foods which saw a 225% increase in revenue from last year and Bombay Exhibition Centre (BEC) which saw a whopping 825% increase in revenue.

NESCO Ltd is a well-capitalized small cap company with zero debt and a very healthy cash position to help it expand its business for the future, riding on the commercial real estate boom that would be coming in this decade in India. It would be prudent for the intelligent investor to take a close look at this company as it can be a good addition to your stock portfolio for the future.

Disclaimer: The content of the above article is for information purposes only. Please consult your certified financial advisor before making any investments.