Optimizing Investment Portfolio Diversification for Better Returns

Your portfolio will continue to beat the market if you keep in mind these simple, important diversification rules.

Introduction

Investing is a powerful tool for building wealth, but it comes with its fair share of risks. One of the key strategies to manage these risks and potentially enhance returns is by optimizing investment portfolio diversification. In this blog post, we’ll delve into the concept of diversification, its benefits, and practical steps to create a well-diversified investment portfolio.

Understanding Diversification

Diversification is the practice of spreading your investments across different asset classes, industries, geographic regions, and types of securities. The rationale behind diversification lies in the principle of not putting all your eggs in one basket. By allocating your investments across various categories, you can reduce the impact of poor performance in any single asset on your overall portfolio.

Check out how I diversified my personal portfolio to get 21.3% CAGR on my returns here.

The Benefits of Diversification

1. Risk Reduction: Diversification minimizes the impact of market volatility on your portfolio. When one asset class underperforms, others may still provide positive returns, helping to offset losses.

2. Consistent Returns: Different asset classes have varying levels of sensitivity to market changes. By holding a mix of assets that react differently to economic conditions, you can potentially achieve more stable and consistent returns over time.

3. Potential for Higher Returns: While diversification doesn’t eliminate risk, it can help you strike a balance between risk and reward. A well-diversified portfolio may allow you to capture growth opportunities in various sectors while managing potential downsides.

Steps to Optimize Portfolio Diversification

1. Define Your Investment Goals: Before diversifying your portfolio, clarify your financial goals, risk tolerance, and investment horizon. Your objectives will guide the level of diversification that’s appropriate for you.

2. Asset Allocation: Determine the allocation of your investments among different asset classes, such as stocks, bonds, real estate, and commodities. The right allocation depends on your risk appetite and time horizon.

3. Broaden Your Horizons: Look beyond domestic markets and consider international investments. Different economies and regions may perform differently under various conditions, offering additional diversification benefits.

4. Choose Different Sectors: Within each asset class, select investments from various sectors. For example, in the stock market, consider industries like technology, healthcare, finance, and consumer goods.

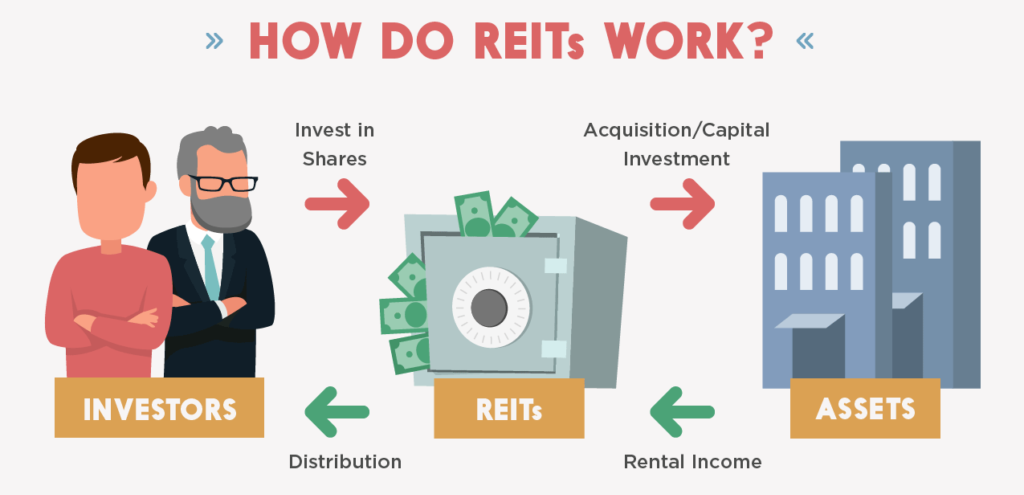

5. Explore Various Investment Vehicles: Don’t limit yourself to just stocks and bonds. Explore exchange-traded funds (ETFs), mutual funds, real estate investment trusts (REITs), and other investment vehicles that offer exposure to different assets.

6. Regularly Rebalance: Over time, the performance of different assets will cause your portfolio to deviate from its original allocation. Periodically rebalance your portfolio by selling overperforming assets and investing in underperforming ones to maintain your desired diversification.

Monitoring and Fine-Tuning

It’s important to note that diversification is not a one-time task. Regularly review your portfolio’s performance and reassess your investment goals. As your financial situation and market conditions change, your diversification strategy may need adjustments to ensure it remains aligned with your objectives.

And to summarize, optimizing investment portfolio diversification is a fundamental step towards managing risk and potentially enhancing returns. By spreading your investments across different assets and sectors, you can create a more resilient portfolio that can weather market fluctuations while seeking growth opportunities. Remember that while diversification can’t eliminate all risks, it’s a strategy that can help you achieve a more balanced and rewarding investment journey.