INVERSE U.S BOND YIELD CURVE AND WAR IN THE MIDDLE EAST – LONG TERM EFFECTS ON INDIAN MARKETS

An unusual and rare phenomenon is happening in the U.S Bond Markets. How will it affect India?

The United States is going through a major crisis.

Decades of zero-interest rates and the double whammy of the unprecedented spending spree during the COVID years have sent the birds back to roost at the Federal Reserve’s nest. As the central bank of the United States, the Federal Reserve’s (Fed) mission is to promote the effective operation of the U.S. economy. It uses monetary policy—actions to achieve maximum employment and stable prices (also known as its “dual mandate”)—to support economic growth.

Effective monetary policy complements fiscal policy—the use of government spending and tax policies to affect economic conditions. The Fed also promotes the stability of the financial system; stable financial markets are necessary for a well-functioning economy. This is very similar to the mandate of the Reserve Bank of India.

To know more about U.S Markets and build a portfolio of U.S stocks, follow The Money Memo on Instagram and WhatsApp

But the COVID years were unprecedented for central banks around the world. They had to take a decision to save their economies from collapsing and also support jobs at the same time (Unemployment in the US surged from 3.5% to 14.7% within three months). And since there was no precedent to fall back upon, some of them resorted to measures that have not been seen in the past – The Fed took it to the next level.

It injected liquidity – another term for printing money – into the markets by directly intervening and buying securities (stocks, bonds and other assets) to support prices and also by bringing the interest rates to zero. It is estimated that the Fed printed almost $3.3trillion in 2020 alone (almost one-fifth of all dollars in circulation) in an economic concept called “Quantitative Easing” or QE.

This concept is applied in emergency situations when the central bank has to print money to keep the economy buoyant. However, this is a stop-gap measure and not a long-term solution.

This excess liquidity found its way to other markets too – Indian stock markets were making merry in the period immediately after the pandemic set in, with the Nifty going from 7500 to 1800 within two years. Something that was unheard of, even in a growing market like India.

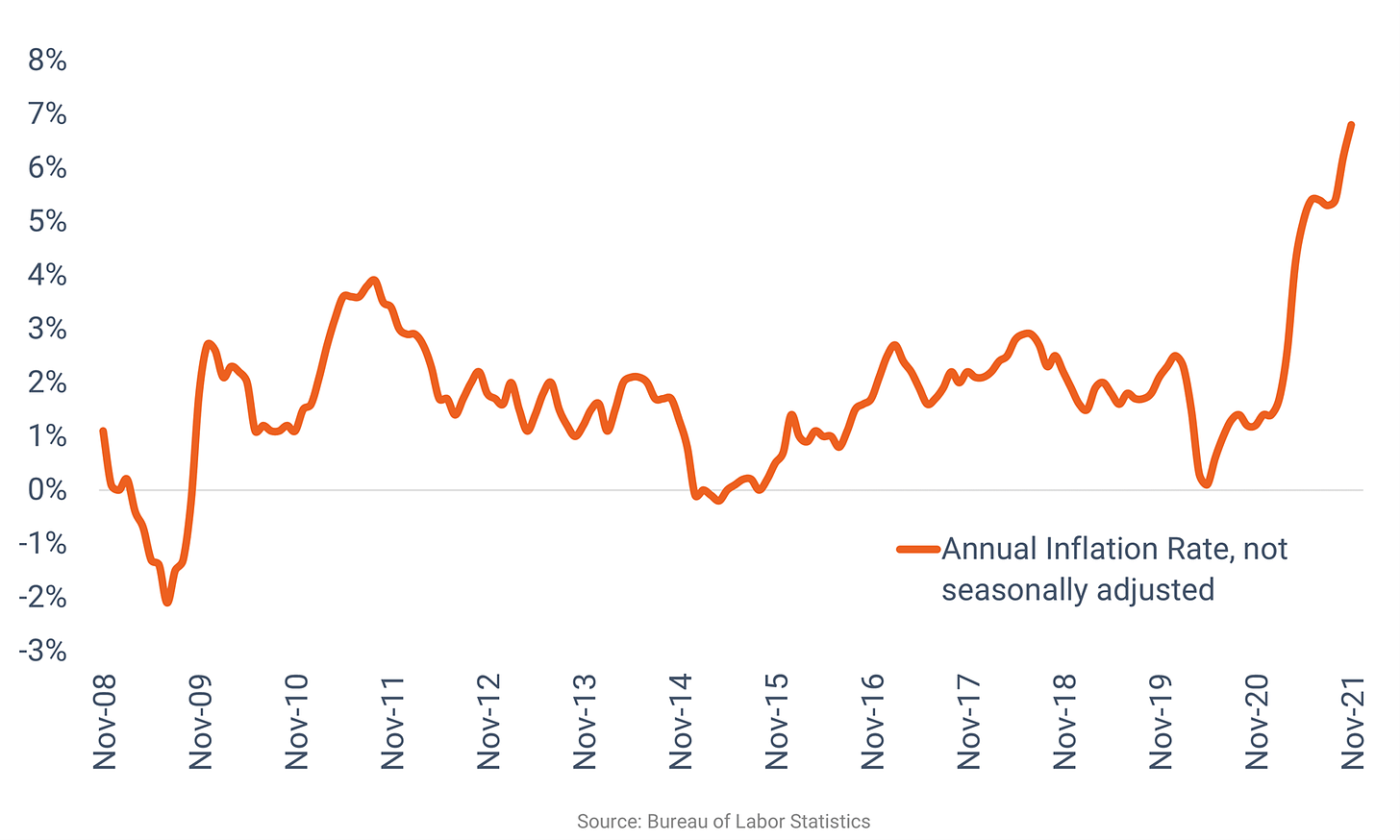

Back in the US, all this printing would come at a terrible price – high inflation. Inflation in the US jumped to levels unseen in four decades – almost to 9%. Even in India, inflation stayed below 9% during the COVID years and after. So, you can imagine why this was a big deal.

Inflation rate in the United States

And hence, once the Fed had arrested the economic crash, they now had to reverse the ill-effects of quantitative easing. In economics parlance, the opposite of QE is “Quantitative Tightening” or QT. This is when the central bank starts shrinking the money supply by increasing the interest rates and capital requirement for banks. This is textbook economics.

But there is a problem.

All these years of zero-interest rates post the 2008-crisis meant cheap money sloshing around in the system and making Americans habitual to it. People were taking up loans to fuel consumption and mortgages to buy expensive homes that they otherwise could not afford. Investors were buying up stocks on the market with access to cheap money, starting a raging bull run on the indices.

And now, with inflation pinching their savings, rates getting higher and oil prices heading up due to the Ukraine war, the going was getting tough for the common American citizen.

So, when the interest rates went from zero to 5.25% real quick, the economy found itself in a shock. In addition, when the interest rates rise, investors start moving their money from equity to bonds – especially US treasury bonds, which are considered a safe haven – and since the tightening happened quick, the money moved away quick as well.

This has been evident in the recent sell-off in the U.S markets – S&P 500 is down a staggering 22.57% in the past week and expected to fall more. This can trigger a sell-off in Indian markets too, albeit at a slower pace because India is being increasingly seen as an economic powerhouse that can hold its own by global investors.

All this flurry of activity has also given rise to a peculiar problem.

An inverted bond yield curve.

The Bond Yield Curve

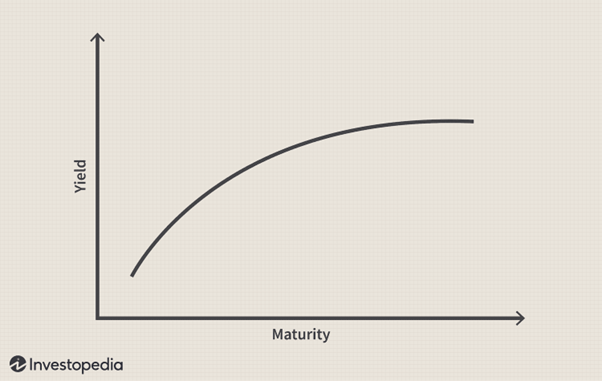

You see, bonds are considered a safe and predictable asset class. In a mature economy – like the U.S – it is quite possible to forecast the performance of a bond from the short term (6 months) to the very long term (30 years). This forecast consists of mainly the bond yield plotted against the time to maturity of the bond. This is called a Bond Yield Curve, and usually looks like this:

Normal Bond Yield Curve

This shows that the yield increases with maturity – a logical explanation, as the investors who hold a bond for longer would have the higher uncertainty (or risk) about its performance and thus will have to be given a higher incentive (interest rate) for them to invest in the long-term bonds.

To learn more about Bonds and how to invest in them, check out my top-rated course on Udemy with more than 420 students here.

For example, let us take a 2-year bond that is priced at $100. Since it’s a short-term bond, you as an investor will consider it low risk, because you kind of can estimate that the central banks would not meddle with the interest rates, so you can still get at least $100 back at the time of maturity and also the interest payments. Since the risk is low, the debtor (govt or a company that issues that bonds) will offer a lower coupon (or interest) on the 2-year bond, as there are enough takers for it.

However, if we take a 20-year bond that is priced at $100, the debtor will have to offer a higher interest payment on it for someone to buy it, because nobody knows what will happen in 20 years – I mean, there could be a war and the country itself could cease to exist! Hence, the interest payments offered on these long-term bonds are much higher. This way, the debtor has peace of mind that he does not have to pay you back for 20 years, and you feel happy getting a higher interest.

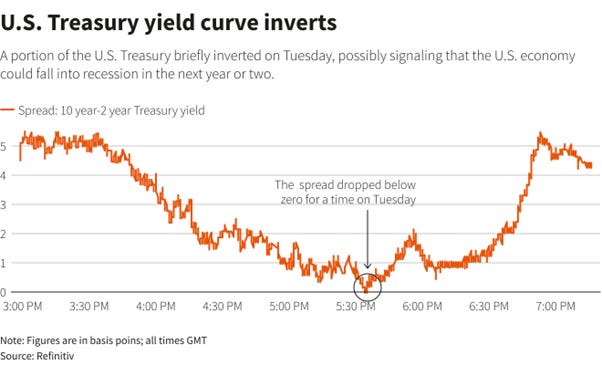

Interestingly, this centuries-old convention has been broken in 2023 in the U.S bond market.

Take a look at the bond yield curve as of now:

Current U.S Bond Market Yield Curve – Inverted

Now your question must be: What does this mean?

Every time this rare event has happened in history, there has been a recession following the event.

It happened in 1987, 1999 and 2008 which were the years that the U.S saw a recession, and now it has happened again in 2023. This data tells us of an impending recession in the U.S economy that many analysts have been predicting for the past six months or so. Indeed, the birds have come back to roost.

And since the short-term bond yields are now higher, we can expect investors pulling out money from the stock market and depositing it in the bond market to protect their capital and also to take advantage of the higher interest payments.

This can also affect FII investment in India, where the current bull market rally has been fueled in a large part by capital flow from foreign shores. Let us see how it may affect our markets this time around.

Effect on India and Its Markets

To understand how a recession in the US affects India and its markets, we need to understand the amount of money that is brought into our markets by foreign institutional investors (FII). Since a recession in the US is accompanied by higher bond yields as we saw above, it is better for these FIIs to pull out their money and invest it in bonds which are safer. Similarly, when the economy does better, the stocks get more attractive, bond yields fall, and the capital takes the other route.

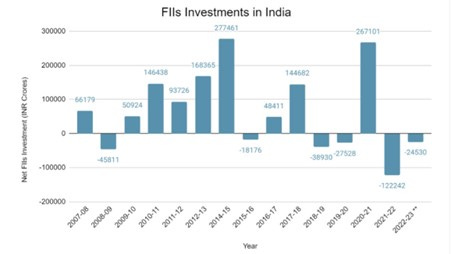

FIIs have been a strong force in the Indian markets for decades as seen in the chart below:

FII Investment in India

As you can see, in the recession year of 2008-09, the FIIs withdrew more than INR 45,811 crores from the Indian markets. In 2020-21, when the rates were almost zero in the U.S, and the bond yields correspondingly low, the FIIs pumped money into the Indian markets.

But 2021-22 is where it gets interesting.

This is the FY when Fed first started increasing rates. And there was talk about them rising even faster than anticipated earlier. This triggered a short correction in the stock markets in the U.S, and also in India. Since this Fed rate hike was the first in three years, most investors expected the QT to continue and pulled out their capital from emerging markets like India and moved to the U.S treasuries, taking advantage of the higher yields again.

To learn more about investing in Indian and U.S equities you can also follow me on Instagram.

In 2022-23, the situation became more certain. Fed was going to keep the rate hike cycle going well into FY24 (which turned out to be the case) and was not reneging on bond yields or shrinking money supply. This can be seen in the FII outflow being arrested on the above chart. I hope that it all makes sense now.

War in the Middle East and Festival Season

Now for the rest of the 2023, what should Indian investors expect? The fall in stock prices in the U.S will definitely have ripples on Indian markets too. However, the pullback may not be as drastic as 2021, and this time it may be more muted. To add to that, the festival season is fast approaching, not only in India but also in the U.S – Thanksgiving and Christmas.

This means consumption is going to soar and companies are going to have a strong quarter. This quarter earnings will be announced in India only in early 2024 and is likely to have a positive outcome on stock prices.

The war in the middle east is going to result in higher commodity prices, including oil, which may put correction pressures on Indian stocks in the short term. But as we have seen in the case of the Ukraine war, investors are not exactly fazed by a localized war – unless the current conflict turns into something bigger. After a brief fall at the start of the Ukraine war, Indian equities have been on a bull rally that is still intact at the time of writing.

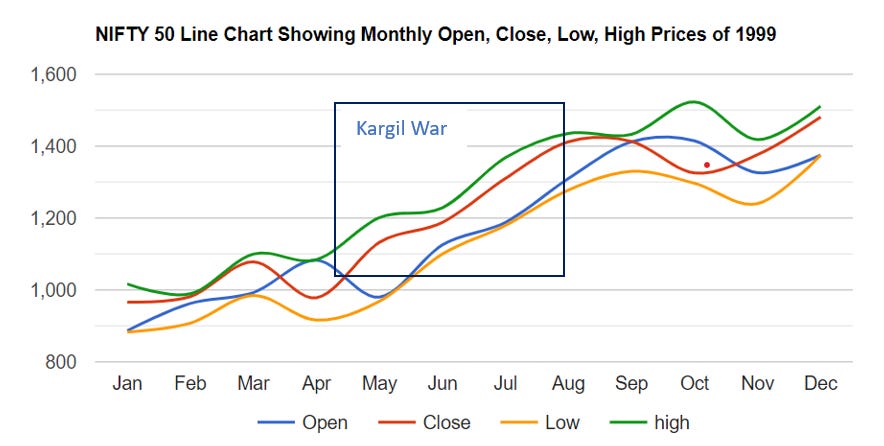

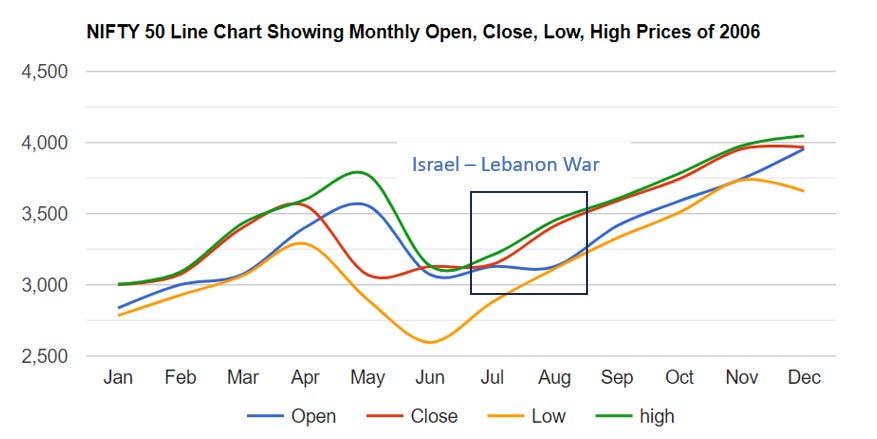

The data shows that even during the war years of Kargil or the most recent major conflict in the middle east – the 2006 Lebanon war – Indian equity markets took it in their stride and continued to inch up. But keep in mind that the liquidity in the Indian markets back then was a fraction of what it is now, and the volumes are much higher as well. Investors should take momentary fall in prices as opportunities to stock up on their long-term investments.

Nifty Performance during the Kargil War

And here’s a look at how the Indian markets performed during the 2006 Lebanon War, which was the last major conflict in the Middle East.

Nifty Performance during the 2006 Lebanon War

However, as per the bond yield data, the recessionary conditions will be put in motion by mid-2024 and this is when we can see a correction in Indian markets as well. Not to mention the Indian stock markets would be at their all-time highs at about this stage, thereby enabling some profit-booking from DIIs as well.

Conclusion

The major development that we have seen from the bond market crash in the U.S, and the subsequent performance of equities in India and the U.S itself, has been the significant decoupling of both the markets from the yesteryears. The magnitude of correlation has significantly narrowed in the recent past, indicating organic strength of India’s own private and public investors based on the strong performances of Indian companies.

However, the retail investor still has to assess market conditions in context with their long-term goals and be unfazed by geopolitical situations – instead take these as opportunities to accumulate more of their favorite stocks, albeit in reasonable quantities.

The future shines bright for India, and this is a shared destiny for many new investors who are beginning to understand the power of equities.

Happy investing!

Great commentary! Really liked how you simplified the whole U.S bond market. Thank you and looking for more!