Mutual Funds – How to Pick the Best

Why Mutual Funds?

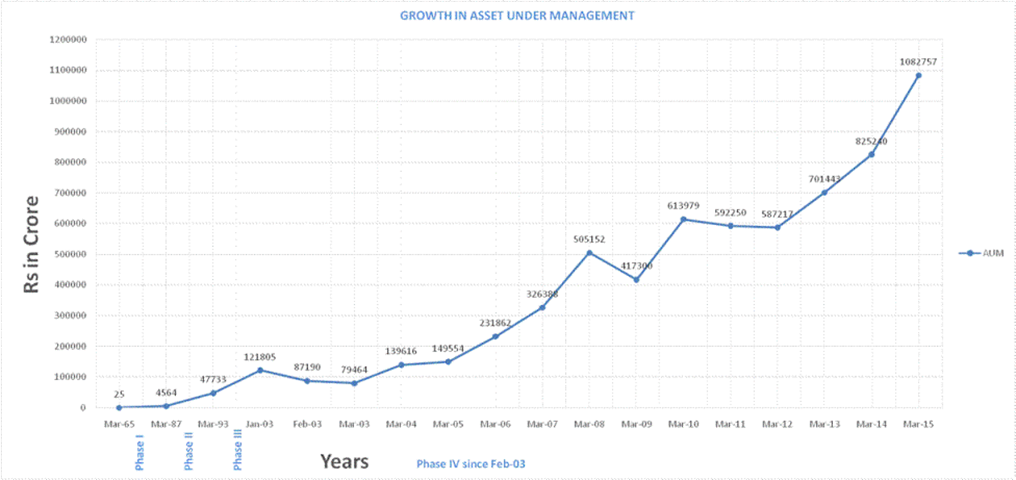

The first-ever mutual fund in India was the Unit Trust of India (UTI) Mutual Fund that was established by an Act of Parliament in 1963. Since then, India has seen a growth in mutual fund assets under management (AUM) from just ₹1 crore to ₹40 lakh crore as of Nov 2022.

That is a 40 lakh times growth in less than 60 years. Well within someone’s lifetime. In the last 10 years alone, the mutual fund industry has increased by 5 times. Now that is a timeline most of us can appreciate. Let us see the growth in a graph below:

In case the math was confusing you, let me break it down further: If ₹1/- was invested in 1963 with UTI, and nothing was done to that rupee since then, you would have ₹40 lakhs right now in 2022.

I know you must have heard such cliched stories umpteen times, but pause for a moment and think about it. Is this not an absolute miracle? Where else would you be able to make returns like that? An average person works for almost 40 years and plans to retire at the age of 60. How many people of that age do you know that have ₹40 lakhs in their retirement kitty?

Not many, isn’t it?

Mutual Funds offer us a passive way to invest our hard-earned money for the long term, managed by experienced professionals with a good track record, at the lowest fees by global standards. And I have already shown above the growth this industry has managed to achieve. They are perfect for:

- Investors who want to start small.

- Investors who do not have the time or effort to research the stock market.

- Investors who do not yet have the knowledge or skill to invest directly in the stock market.

- Investors who want a long-term investment vehicle to create wealth.

My own mutual fund portfolio consists of five different funds that have given me an annualized return of 17.7% over the last decade. To be fair, this is a very realistic return and achievable by anyone. You just need to research the right kind of mutual funds and stay invested patiently.

Equity mutual funds are the perfect solution for people who want to own stocks without doing their own research. – Peter Lynch

When I look at investing in a mutual fund, I look at the following important factors:

- Quality of the fund house or the AMC

- 7-year historical return performance

- Total Expense Ratio, or the fees charged by the fund house

- Track record of the fund manager

Let me share how I do this in detail.

Quality of the Fund house or AMC

Do you ever spend your money on something whose quality you are not sure about? I certainly don’t.

Whenever I’m investing my hard-earned money in an asset, I check for its quality first. Every asset class has instruments that scream quality and those that are poor. You must always look for quality – whether it’s a stock, a bond security, a mutual fund or a govt scheme. Learn how to pick quality assets here : A Guide to Financial Assets

When looking to invest in a mutual fund, I first look at the Fund house or the Asset Management Company (AMC). This is the institution to whom you will be handing over your carefully saved, precious money to – in the form of SIPs or a lumpsum payment. You must ensure you have faith in that institution.

For example, take a look at the following AMCs:

These are companies that we hear about everyday. Not only that, they are also business conglomerates backed by their own banks which are massive and relevant internationally. It is highly unlikely that these AMCs would shut down overnight or have liquidity issues when you need to withdraw your investment at a time of an emergency.

However, this may not be the case with some other AMCs. Like Franklin Templeton AMC for example – they had to wind down 6 of their debt funds due to a liquidity crisis leaving the investors in the lurch:

Franklin Templeton Mutual Fund Crisis – What Really Happened

As an investor, we are already managing returns risk on our investments due to the volatile movement of the markets. The last thing you need is to manage another risk of the AMC winding down or unable to return your money. So make sure you have faith in the AMC. For me, this is very important as it gives me a lot of peace in my investing journey to know that my money is well-invested with a reputable AMC.

7-year Historical Return Performance

How long is your investment horizon? Do you intend to withdraw your investments at the end of 5 years? 7 years? 10 years?

For me, this horizon is between 7 and 10 years. I have done enough research and study to understand that mutual fund investments create wealth only in the long term. Nobody is getting rich by monthly SIPs that are invested just for 3-4 years. This is because compound interest only starts to kick in by the end of the 5th year (in my own experience), and that is the point when the value of your investments move to the next level.

So I am interested to know the historical performance of the mutual fund over the past seven years at least. And I usually target this number to be between 18-20% for Small Cap Funds and 14-16% for all others (Index Funds not included). The reason being that this is the target annualized returns I need to complete my investment goals (more on my goals later). Mind you, past performance is not a foolproof indicator of the future – but I’m more comfortable putting my money into a fund whose past performance has been in line with my goals.

Now you may ask, “What if the fund itself has not been in existence for 7 years?”Well, in that case, I’m ready to skip that particular fund and continue my search for another one that has my target 7-year historical performance return. Again, this is just me, and the reader may choose to do so as they please if they are confident in the longer-term future performance of a particular fund. As I have said before in my previous newsletters, I like to keep my risk as low as possible and not shift from my system. I have shared the same on my Money Memo Podcast here:

Total Expense Ratio (TER)

A mutual fund charges you a fee for managing your money. This is standard; any service that you avail will have a fee associated with it – whether it be a doctor’s appointment or a visit to the salon. This fee is called the Total Expense Ratio (TER) and usually expressed as a percentage:

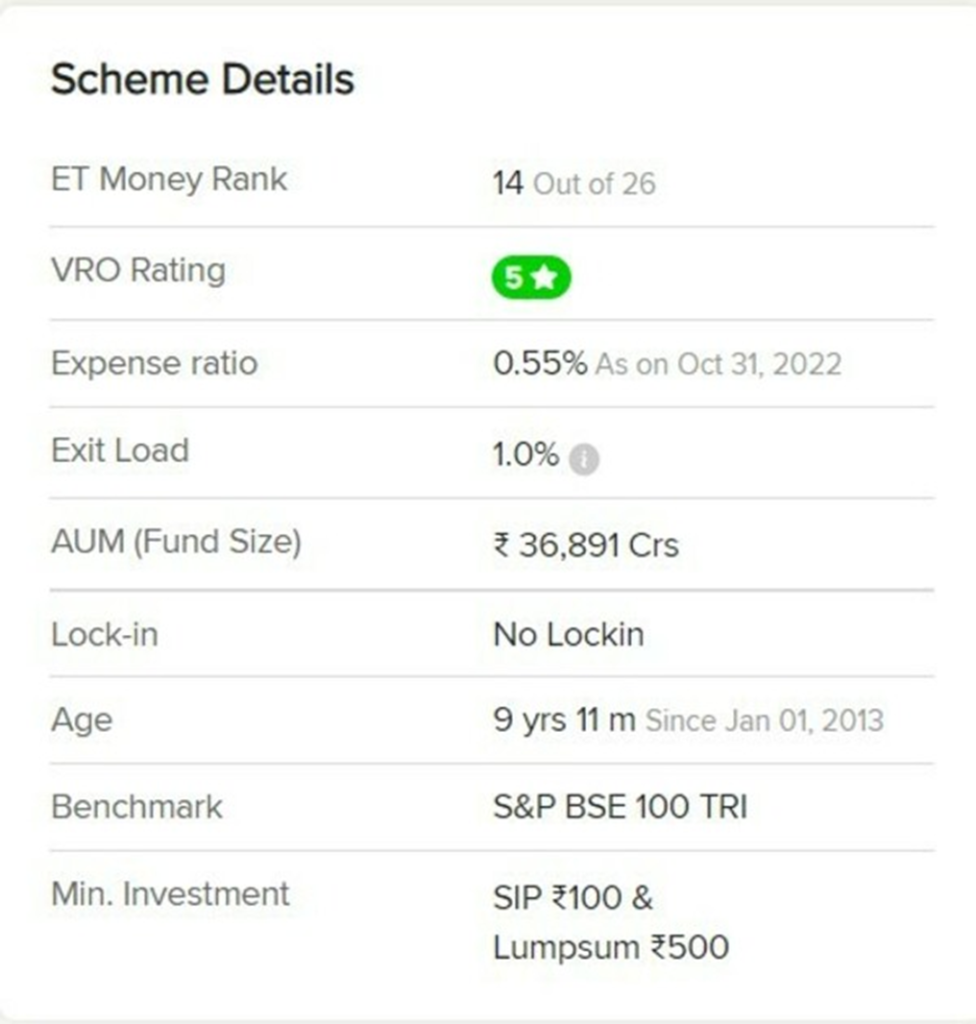

As you can see above, Axis Blue Chip Mutual Fund Direct Growth charges a fee of 0.55%. What does this mean? It means that if the fund makes a 15% return annually, what YOU get will actually be a 14.45% return after the fees (15% – 0.55%).

Remember that this fees can eat away at your returns if it’s particularly high. Some funds that have a good track record will also increase their TER as they get more investments – because as I said before, they will be considered quality and more investors like me will flock to them, increasing the demand.

I personally don’t like any mutual fund that charges a TER of more than 0.75%. The only exception I would make is if the fund invests in international assets – like US stocks or commodities for example. Since the mutual fund will have higher administrative and forex costs to invest in such assets, it is reasonable to expect that their fees would be much higher than the domestic funds. So opt for mutual funds that charge you a lower fee while balancing a good rate of return. This should be a no-brainer for us Indians who look for a bargain wherever we go!

Track Record of the Fund Manager

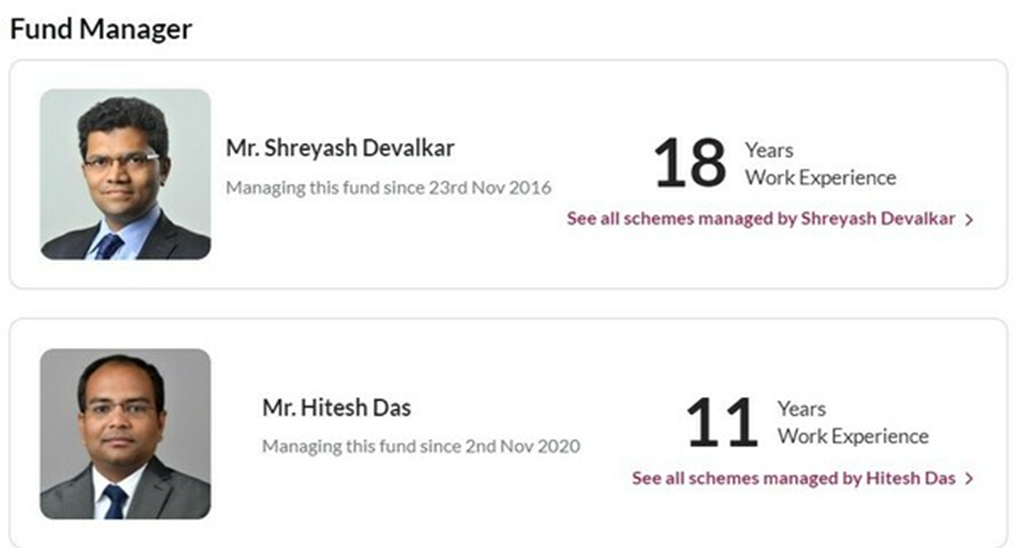

This point has to be looked at in the larger context of the quality of the fund house. Usually, the top fund houses or AMCs will have high-performing fund managers in their ranks too. A fund manager is responsible for allocating the pooled funds of the investors that is invested into the mutual fund. He/she is usually someone from a finance background with a wide range of experience in fund management. A mutual fund will have the name and track record of its fund manager(s) on its website. For example, the fund managers of Axis Blue Chip Fund are as given below:

If you click on Mr. Devalkar’s photo, you will see a brief resume about him and his qualifications. It will also include his return performance.

This way, you can check and evaluate the track record and performance of the fund manager(s) who will be managing your investments. In my opinion, this adds to the peace of mind I can get by knowing that a qualified professional is managing my money. Again, this goes back to one of my basic tenets of investing – Risk Management.

The Takeaway

There you have it – my four major criteria for choosing a mutual fund for the long term. These points have kept me in good stead over the past decade or so, and I have been very happy with the returns from my mutual fund portfolio. What started off as a meagre ₹5000/- SIP in 2011, has blossomed into a balanced portfolio with a considerable corpus. You may learn more about it here:

I can say with confidence that these points might also do you a lot of good if you can research and invest according to your own risk appetite and returns expectations. One thing to keep in mind is that mutual funds work for the long term, and patience is key.

If you liked this week’s simple lesson, consider sharing it with your friends and family and drop a follow on Twitter – ajay_invests and on Instagram – ajayinvests to help me share more useful and practical information about finance and economics with you 🙂

If you’re too busy to read my weekly newsletters, you may check out The Money Memo – A Podcast on Spotify to enjoy simplified financial concepts on the go!

Happy Investing!

Ajay