The Hindenburg – Adani Quandary : What You Need to Know

A quick and simplified take on Hindenburg Research’s Big Short of Adani stocks

What’s Happening Exactly?

A US-based investment research firm – Hindenburg Research – recently published a scathing research report on Adani Group of companies, accusing the top management of corporate fraud and stock manipulation. The report mentions the findings of a 2-year investigation that throws light into Adani Group’s accounting management practices and other irregularities.

Hindenburg Research Report on Adani Group

Hindenburg says that it has taken a short position against Adani stocks as its findings has led them to believe that a collapse in stock prices is likely in the near future. The firm’s modus operandi has remained the same for many other companies which it has short-sold before. Their track record can be seen here.

Adani Group has vowed to respond with a point-by-point rebuttal of the same, including threats to sue Hindenburg in the US jurisdiction. Details are still awaited on this as it’s a developing story.

Let’s take a brief look into the controversy, and break it up into four major points:

- What are the allegations and why have they published the report now?

- How has the firm engineered their short position in Adani stocks?

- How have they benefitted from the panic that has set in among investors?

- How will this affect the markets?

Who is Hindenburg Research?

Before we understand who they are, here’s some history on their name.

LZ Hindenburg was an airship that was constructed in Germany that went down in a terrible accident in 1937. Many of you might know this as the Hindenburg disaster. The airship itself was named after Field Marshal Paul von Hindenburg, who was the ruler of Germany from 1925 to 1934. The airship went down in flames causing 35 fatalities while trying to land in New Jersey, USA after a transatlantic flight from Frankfurt. Germany.

Iconic picture of the Hindenburg disaster.

Hindenburg Research was inspired by this theme, and they are known to look for stocks of companies who they expect to go down spectacularly like the airship itself. That makes morbid sense in a way, I guess. The firm is based in the United States, founded by Nathan Anderson, and commenced operations in 2017. The firm operates under the concept of “activist short-selling” – an investment idea that stems from protecting the retail investors from fundamentally unsafe stocks, but also making a profit from a short position against the same companies.

A short position, for those not in the know, is merely the opposite of a long or buy position in a stock or investment asset. It is essentially a trade where you sell high and buy back low. This can be a complicated concept, but is in fact a very common activity in the stock markets. We shall discuss this in detail later in this post.

What is a short position and how does it work?

Allegations Against Adani Group and Timing of the Report

Let’s look at some of the allegations against Adani group companies that Hindenburg Research has put forth in their controversial report:

- Stock Manipulation

- Accounting Fraud

- Unsustainable Debt Levels

- Money Laundering

- Siphoning Investor Funds through shell companies

Again, please go through the research report on their website to understand the entire gamut of allegations levelled by them. These are just a few major ones that have been picked to simplify the explanation of the issue in this article.

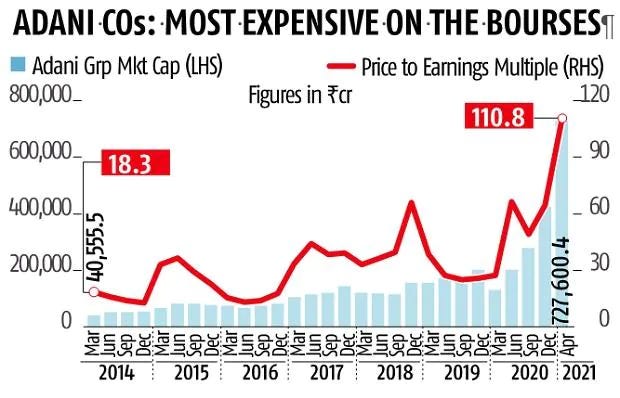

Out of all the above points, there is one point that has been common knowledge for a while now – the high leverage or debt levels taken on by Adani companies. In addition to this, the Price-to-Earnings (PE) ratios of most of the listed Adani companies are some of the highest in Indian markets. This is definitely not a good sign; but one must also keep in mind that most Adani companies have very high capital-intensive operations. This means a lot of their capital will have to come from debt or pledging of their own shares which have shot up in value in the last 2-3 years.

Adani Group valuation over the years.

Either way, an investor needs to understand that highly leveraged companies often face difficulties in a market downturn; smaller companies even go bankrupt. While nothing of that sort has happened to Adani companies, it doesn’t take much for the worst to happen. Even big companies like Enron – which was once the most valuable company of America – have collapsed like a house of cards.

Enron – Fall of a Wall Street Darling

Now let’s look at the timing of the report. You will find something very interesting here.

Adani Enterprises, one of the biggest company in the Adani Group, is about to go for a Follow-on Public Offer or FPO, in the near future. An FPO is simply a second part to an IPO or Initial Public Offering. It is when a company listed on a stock exchange issue new shares to existing shareholders and new investors. An FPO is not that common in most developed stock markets. There are three major reasons why a company goes for an FPO:

- To expand the shareholder base

- To reduce the debt of the company

- To raise additional capital for the company

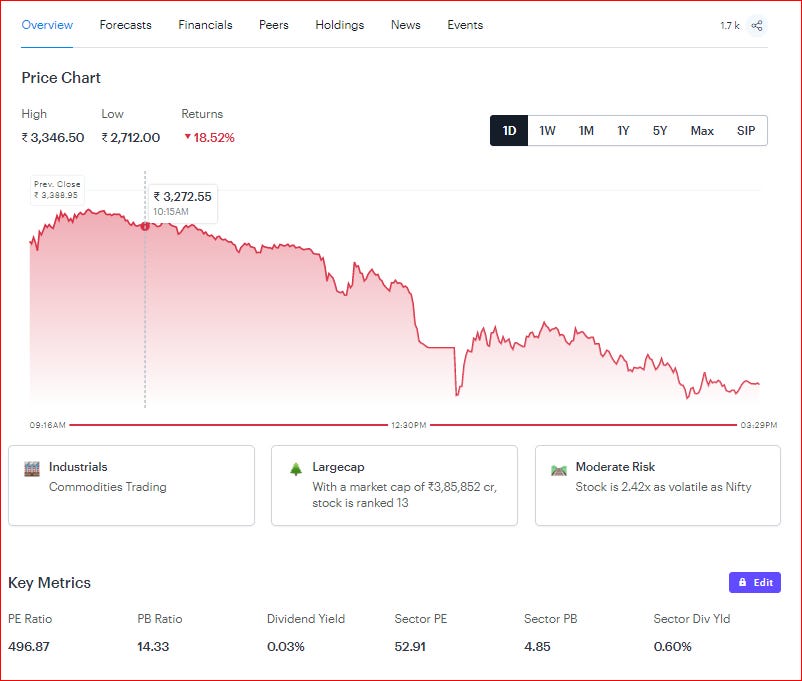

As you can see, Adani Enterprises is in dire need of new capital and lowering its debt structure. It is also trading at almost 400x PE multiple (as on 29 Jan 2023) and 10x PB ratio. Even if you compare its peers in the same industry, these are alarming numbers.

Adani Enterprises snapshot (Courtesy: TickerTape)

However, there is a catch.

The FPO price of Adani Enterprises is at a premium to its current market price (CMP). What does this mean? It means that even though the CMP in the secondary market (as on 29 Jan 2023) is INR 2761/-, the FPO price is set at INR 3200/-! Why would it make sense for a new investor to subscribe to the FPO when he/she can get the same stock at a lower price in the secondary market?

Exactly. It makes no sense.

And this has reflected in the poor subscription numbers for the Adani Enterprise FPO – only about 2% of the retail portion of the FPO has been subscribed to at the time of writing. However, this has an even more important connotation to Hindenburg Research. Let’s find out why.

If the FPO becomes successful, it essentially means that Adani Enterprises stock prices will rally from its CMP (2761/-) and converge with the FPO price (3200/-). It may even go higher from there depending on investor sentiment. What does this mean for a short seller in the same stock? The short seller will have to either square off his position at a huge loss (because the price has rallied instead of coming down as per his market view) or he will have to bring in more collateral as margin to sustain his short position.

This is a very bad situation to be in, and can even make the short seller go bankrupt in one fell swoop. If he had taken other investors’ money to take his short position then it will be even worse. And guess who has a big short position against Adani Enterprises at the moment?

You guessed it! Hindenburg Research.

Hence, it is in Hindenburg’s interests that the FPO doesn’t succeed. In addition, if the research report creates panic among investors of Adani stocks, their short position now gets into profit – thereby killing two birds with one stone.

That explains the timing of the research report and it makes perfect sense.

How have They Engineered their Big Short?

It is not easy for a foreign investor to short-sell a stock in the Indian markets. In fact, the stock exchanges regulator SEBI, has explicitly banned short selling of shares by Foreign Institutional Investors (FII). The same can be viewed on the link below:

SEBI Order – Ban on Short Selling by FII

Hindenburg Research does not have any subsidiaries in India. Hence, it would be illegal for them to short-sell Adani stocks in India (onshore). Therefore, it is likely that they have engineered their short in an offshore market (like Singapore or London). They themselves have disclosed that their short position has been achieved through US Bonds and non-India traded derivative instruments. This could mean that they have put up the US Bonds as collateral/margin and used an OTC derivative instrument (something that is not available to the regular public) to engineer this short.

Let’s see how it works.

You can short a stock in the cash market (regular stock exchange) or the derivatives market (Futures & Options). When you short a stock (say Adani Enterprises), you essentially “borrow” that stock from someone – usually your broker – and then sell it in the open market. Let’s assume you short sold the stock at 2700/-. Now with all the negative commotion going on, let’s assume the price crashes to 2200/-. At this time, you “buy back” the same stock from the open market at 2200/-, and return it to the broker (from whom you borrowed it for 2700/-). You get to keep the difference, that is 500/-.

Cool, huh?

Maybe, but it’s not as easy as it sounds.

When you borrow a stock, you have to post collateral with the broker – to cover the risk of the stock price going UP instead of DOWN. This collateral is called Margin. If your view was wrong about Adani Enterprises, and it’s price went from 2700/- to 3000/-, you are in a loss of 300/-. If it goes higher, the loss also accumulates higher and results in a “margin call” – a literal phone call from your broker to bring in more margins. This is a risk that is non-liquidating unless you “square off” your position or deliver the loss in more Adani Enterprises stock back to the broker.

It is a very risky trade. And this is why short-selling is not encouraged in most markets. It increases the chances of default and can even lead to a market collapse if the positions are too big.

A great movie recommendation for stock market enthusiasts.

It gets even more complicated in the derivatives segment, but you get to take more leverage with them. Thus, you can take a position that is much higher than what you can afford, but your losses also compound accordingly. To sum up, derivative shorting can make you go bankrupt overnight.

And Hindenburg has taken such a position using derivatives. As this would be a bespoke Over-The-Counter (OTC) instrument, the opportunity cost would also be consequentially high, due to the unavailability of any other standard instrument for them to short the market. Anyone remember Credit Default Swaps that Michael Burry created with Goldman Sachs for him to short the housing market in the movie The Big Short?

Michael Burry closes the deal with Goldman Sachs to create a bespoke instrument for him to short the housing market – The Big Short (2015)

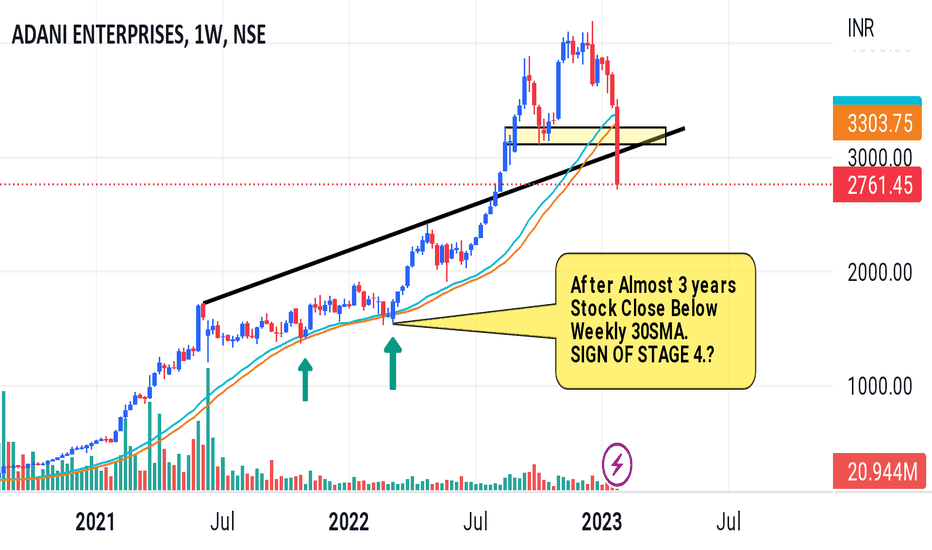

Since they have been investigating Adani Group for the past two years, my bet is that they have initiated the short sometime in 2022, once they had all the data they needed. But Adani stocks have not seen any meaningful drop in prices in the last one year; in fact, they have been on the upswing. This means that Hindenburg might already be forced to put up more and more collateral/margin to sustain their short.

A successful FPO of Adani Enterprises might push them over the edge, and even make them go bust.

The Report Goes Live and Panic Spreads

On 24 Jan 2023, Hindenburg Research published their report with 88 questions for Mr. Gautam Adani, the Chairman of the Adani Group. It took a while for the report to get the attention they wanted. By 25 Jan, the panic had started to set in, and Twitter was alive with discussions on the same. Major news channels picked up on it and commenced extensive coverage. But since the next day was a market holiday on account of Republic Day, Adani stocks did not experience a price shock, but had started on a downtrend.

On 27 Jan, the lid fell off.

On Friday, Adani Transmission, Adani Green Energy, and Adani Total Gas closed at 20% lower circuits each. While Adani Power and Adani Wilmar hit 5% lower circuits each. Adani Ports wasn’t performing any better and tumbled by over 16% at the end of the day. Meanwhile, Adani’s flagship company, Adani Enterprises, which launched its FPO on Friday, nosedived by around 20% before closing at ₹2,762.15.

The Adani Group has lost $48 billion in value since the Hindenburg Research report was published and the net worth of Mr. Gautam Adani has come down by almost $21 billion, making him the 7th richest in the world from his earlier ranking of 3rd. This is probably one of the largest wealth erosions in history in such a short time, probably behind Amazon’s and Jeff Bezos’ fall in 2022.

Adani Enterprises Stock Chart (Courtesy – TradingView)

It is beyond any doubt that the biggest beneficiary of this price action will be Hindenburg Research, breezing away to a windfall profit (pun not intended) on their short position. Even if not in profit, this will help them to free up the extra margins and use that capital for another opportunity.

Who Lost?

Whenever something of this kind happens in any market, or economy, there is usually one entity that always stands to lose.

The common man.

As of Tuesday, one of the biggest investors of Adani Group was the Life Insurance Corporation of India (LIC). They had an exposure of more than INR 75,000 crores ($9.5 billion) to Adani group companies. This is almost a 37% stake in the Adani Group! In addition to this, mutual funds – especially Index Funds – had another INR 25,000 crores ($3.2 billion) or so, making the total investment from the common man at around INR 1 lakh crores.

LIC lost nearly INR 19,000 crores in just the past week after the Hindenburg Research report came out. This is a massive 27% loss in two days! I am sure the mutual funds have also lost a similar percentage of their money in Adani stocks. If the fall continues, it can impact the whole Indian market disastrously. In addition to these DIIs, several retail investors also have direct exposure to Adani stocks – they will also feel the punch, as these scrips have given multibagger returns over the past three years.

After all, that is the nature of markets. And capitalism.

What Happens Next?

The fall in prices of Adani stocks are expected to continue if the market downturn of Friday (28 Jan 2023) was any indicator. It can even seem like a self-fulfilling prophecy, as the prices of the group companies go through a correction – bringing down the PE ratios to more rational levels. If the situation gets too extreme, the indices themselves – Nifty and Sensex – can see broad-based corrections. It is this kind of event, after all, that keeps the valuations of the indices in check.

Adani Group will vehemently oppose the allegations by Hindenburg and would probably publish a counter report to reinstate the faith of the institutions and numerous investors that have helped the meteoric rise of the group and Mr. Gautam Adani on the world stage. There could be investigations into the allegations by competent authorities, as this is the only way to establish the truth – Hindenburg has vested interests in the collapse of one of the largest business conglomerates of India anyway, so it would not be prudent to believe their report at face value.

As an investor, you must continue employing your successful strategies to pick the right stocks and leave out the noise. A correction in the market should always be looked at as an opportunity. For me personally, Adani stocks never passed my screeners of PE and Debt-to-Equity ratios so my exposure is nil. However, one should keep in mind that they are capital-intensive and maybe acceptable by a multitude of investors, LIC included.

Let us hope the truth comes out soon.

Happy investing!

(Disclaimer: The above article only interprets the market news on account of the Hindenburg report. The veracity of the report itself can only be verified by a competent authority like SEBI or the Government of India. The author does not condone the Hindenburg research report in any way nor has any investments in any companies of the Adani Group.)